Consumer Confidence Falls, But Spending Patterns Shift in Unexpected Ways

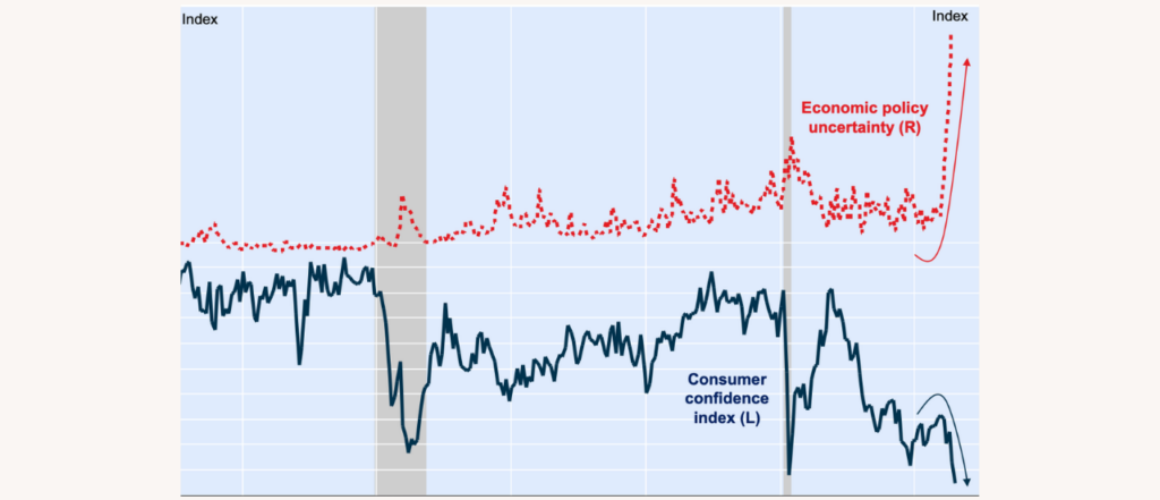

Canada’s consumer confidence index has dropped to its lowest level since the COVID-19 recovery period, driven by rising interest rates, housing affordability concerns, and general economic uncertainty. Yet, despite the downturn in sentiment, recent retail and service sector data suggests a curious trend: spending hasn’t collapsed — it’s simply shifting.

Canadians are reprioritizing how they spend — not necessarily how much — which is forcing businesses to rethink product offerings and economists to revise consumption models.

A Confidence Drop Rooted in Real Pressures

A national survey revealed a 12% year-over-year drop in confidence due to:

- Inflation in essential goods like groceries and gas

- Higher interest rates for mortgages and car loans

- Job security concerns in major sectors

- Political and trade policy uncertainty

Where Canadians Are Still Spending

Instead of large purchases, spending is shifting toward lifestyle experiences:

- Dining out: Restaurant visits up 5–8% from last quarter

- Entertainment: Streaming subscriptions and cinema tickets rising

- Local travel: Weekend getaways and regional rail travel increasing

- Wellness: More spending on spas, mental health, and fitness

What This Means for Retailers and Policy

Retailers are adjusting by:

- Promoting smaller, high-value personal items

- Bundling service-based experiences

- Offering loyalty programs and flexible payment options

- Using influencer campaigns for impulse engagement

A New Normal for Consumer Behavior?

Rather than waiting for better times, Canadians are seeking immediate satisfaction through manageable spending. This is creating a consumer landscape where emotional and psychological drivers outweigh traditional income-based predictions — a more volatile, but more resilient economy.

Conclusion

Canada’s low consumer confidence rating is real — but so is the ingenuity of its consumers. While household budgets are under pressure, Canadians are finding new ways to spend with purpose and joy. For businesses and policymakers alike, understanding this emotional-economic shift is vital for adapting to the times.