Honda Delays $15 Billion EV Plant Plans in Canada Amid Market Uncertainty

In a significant and surprising move, Japanese auto giant Honda Motor Co. has announced the postponement of its $15-billion electric vehicle (EV) manufacturing investment in Canada, citing changing market dynamics, slowing consumer demand, and rising geopolitical tensions. The project, which was expected to transform Ontario into a North American hub for EV production, will now be delayed for at least two years, a decision that has raised serious questions about the near-term future of Canada’s EV ambitions and industrial strategy.

A Setback for Ontario’s EV Dreams

Honda’s planned investment was touted as a major milestone in Canada’s push to become a global player in electric mobility. The $15-billion package included construction of four EV-related plants in Ontario: a vehicle assembly facility, a battery plant, and associated supply chain infrastructure. Central to this plan was the modernization of Honda’s Alliston plant, located just outside Toronto, which would have been retooled to produce next-generation electric vehicles by 2028.

Provincial and federal officials, including Ontario Premier Doug Ford and Prime Minister Mark Carney, had previously hailed the initiative as a “once-in-a-generation opportunity” to anchor thousands of jobs and boost local economies. The delay is therefore not just a corporate decision—it represents a major economic and political recalibration.

What Prompted the Delay?

Honda’s explanation rests on three interrelated challenges:

-

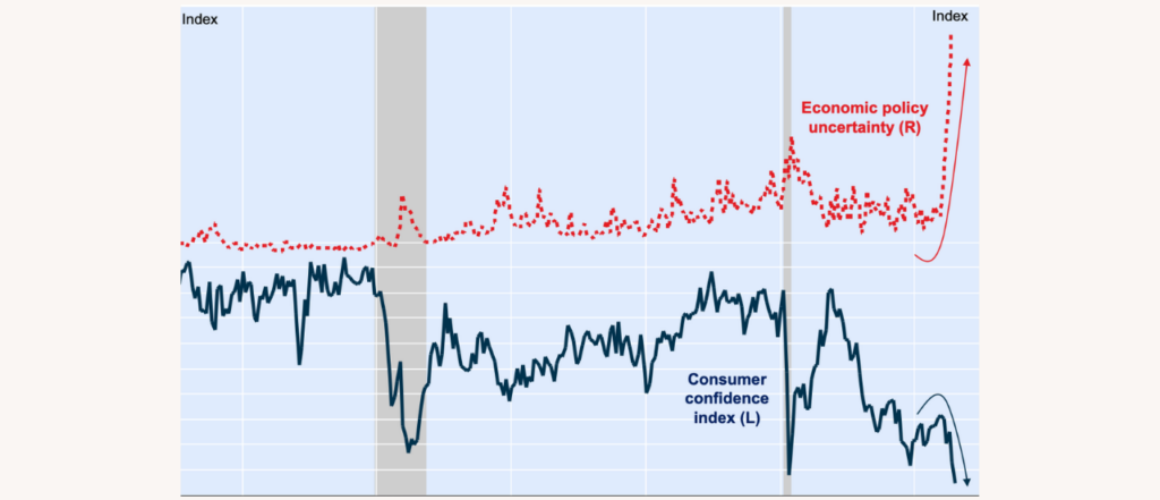

EV Demand Slump: After years of hype, EV sales have slowed across key markets, including North America. Despite generous government incentives and growing environmental awareness, high upfront costs, range anxiety, and insufficient charging infrastructure continue to deter mainstream adoption. Honda, like many automakers, is reevaluating whether the market is expanding quickly enough to justify such aggressive capital outlays.

-

Geopolitical Tensions and Tariffs: The return of Donald Trump to the White House in early 2025 has reshaped the trade calculus for global automakers. New tariffs on vehicles and components exported to the U.S.—especially those manufactured outside its borders—have injected significant financial risk into projects like Honda’s Canadian EV strategy. The company now projects a 59% decline in operating profit by the end of fiscal 2026, with tariffs cited as a primary driver.

-

Economic Uncertainty: Rising interest rates, inflationary pressures, and volatility in supply chains have all combined to make long-term forecasting more difficult. Honda’s leadership emphasized the need to pause and reassess before committing further resources.

No Job Losses – For Now

In a move likely aimed at preventing political backlash, Honda confirmed that current employment levels at the Alliston facility will remain unchanged. The company assured local workers and stakeholders that existing production lines for gasoline-powered vehicles will continue as scheduled.

However, this reassurance does little to soften the broader disappointment. Municipal leaders and regional economic planners had already begun integrating Honda’s EV strategy into their long-term development plans, and many smaller suppliers were positioning themselves to benefit from new contracts and technology upgrades.

A Broader Industry Trend?

Honda’s announcement is part of a wider trend within the automotive sector. In recent months, General Motors, Ford, and Volkswagen have also either scaled back or delayed their EV investment schedules. The industry appears to be entering a “reset phase”, moving away from the breakneck speed of EV expansion toward a more cautious, demand-driven approach.

Experts now believe that the next wave of EV growth may depend more on infrastructure development and cost parity with gasoline vehicles, rather than sheer production capacity.

What’s Next for Canada’s Green Manufacturing Goals?

The federal government has yet to issue a formal response, but internal sources suggest there is concern about whether other companies might follow Honda’s lead. Canada’s recent climate pledges hinge on widespread EV adoption and domestic manufacturing capacity. A two-year delay, though not permanent, could throw a wrench into federal timelines and credibility.

That said, industry insiders do not view Honda’s move as an abandonment—rather, a strategic pause. The company has emphasized that it still believes in Canada’s long-term potential as a manufacturing base, and will “monitor global market conditions to determine optimal timing.”

Honda’s decision to delay its massive EV investment in Canada reflects both the volatility of the current global market and the complex realities of transitioning to a green economy. For Canada, this moment presents both a challenge and an opportunity: a challenge to keep global investors confident, and an opportunity to double down on infrastructure, innovation, and policy clarity to ensure that when companies like Honda are ready to move forward again, Canada remains at the top of their list.